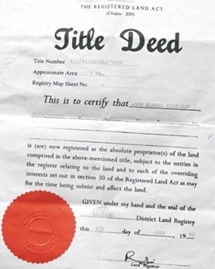

A title deed of property is a document worded in legal language, which is used to identify who the real owner of a piece of property is. While its main purpose is to identify the ownership of property, a title deed also defines a few more things, such as the privileges given to the owner of the property, as well as the rights they hold over the property in discussion. Additionally, restrictions as to things such as readjusting the property by say, improving it are detailed. It’s important to ensure that your deed gives you the allowance to avoid legal problems in the long run.

When the property in discussion is a piece of real estate, the title deed is held by a lender, assuming that a mortgage has been taken for the property. The title deed of property acts as the collateral. As such, if the borrower is unable to fulfill their financial obligations to the lender, they (lender) have every legal right to sell the property to another party, and transfer the deed to them if the sale is finalized.

Given the importance of these legal documents, it’s advised that you place them in a safe place. You can have it locked away in a safe, and only retain copies of it should they be requested in a legal setting. The process of acquiring a new title deed is exhausting (copy of property deed are always kept by the authorities) and that underscores the importance of keeping them safe to begin with. Alterations to the deed can be made, say, when there’s transference of ownership. For couples that want to have both names on the title deed of property they bought together, there is a special deed crafted just for them with correspondence property deed form and document. It allows them equal control over the property, implying that one party cannot make any changes to the property, or sell it, without formal consent from the other spouse.

Survivorship clause in title deed of property

Title deeds contain something called survivorship clause. It is common in deeds that are jointly owned by two or more persons. Basically, the clause indicates the fate of a share of the property should the owner meet an untimely death. The clause needn’t exist in deeds that are individually owned. That’s because the will written by the title deed of property holder can specify who the ownership of the property will go to. The new owner has to acquire the property deed and have their name written on it, as they assume control over the property.

Transference of a title deed of property means transferring not only the property itself, but also responsibility over it, including but not limited to relevant property tax payment. If there were payments being made, they are supposed to be continued by the new owner. To ensure the greatest level of protection, buyers insist on getting general warranty deeds, as they still commit the seller to the property, in case an undesired feature of the property is uncovered. In such a case, the seller would be entitled to undertake any repairs or replacements that need to be made as that is part of the guarantee they made.